Florida Tax Sale List Site Map

Tax lien sales and tax deed

sales.

If the tax certificate is not

redeemed, the certificate

holder cannot institute

foreclosure and receive the

deed; rather, a public deed

sale must occur.

Tax lien sales occur on or before

June 1.

Counties Featuring online Tax Lien

Sales:

Brevard http://brevard.taxsale.com

Charlotte http://charlotte.taxsale.com

Citrus

http://www.bidcitrus.com

Escambia

http://escambia.taxsale.com

Gilchrist

http://gilchrist.taxsale.com

Lake

http://www.bidlaketax.com

Leon

http://www.bidleon.com

Marion

http://www.bidmarion.com

Miami-Dade

http://www.bidmiamidade.com

Okaloosa

http://www.bidokaloosa.com

Orange

http://www.bidorangecounty.com

Osceola

http://www.bidosceola.com

Palm Beach

http://www.bidpbtc.com

Polk http://polk.taxsale.com

Putnam http://www.putnametaxsale.com

Sarasota

http://sarasota.taxsale.com

St. Johns

http://www.sri-auctiononline.com

St. Lucie

http://www.bidstlucie.com

Sumter

http://sumter.taxsale.com

Volusia

http://www.bidvolusia.com

Broward County

954-765-4697

Charlotte County

941-743-1356

go to

http://www.cctaxcol.com/taxfiles.htm

to download list

Dade County

Duval County

Delinquent File Download

On April 1st of each year the

current year Real Estate taxes

become delinquent. If the taxes

remain unpaid after the

advertising period has expired, a

certificate for the unpaid taxes

can be sold at auction. This sale

takes place on or before June 1st

of the year they become

delinquent. Those certificates not

sold at auction are transferred to

the City of Jacksonville where

they may accrue interest until

paid. Certificates can be

purchased by individual buyers

from the city according to the

rules and laws governing

delinquent taxes.

The first file,

Unpaid Certificates City

Held Certificates,

list those certificates, held by

the City of Jacksonville, which

remain unpaid as of the last day

of the previous month. This file

contains certificates from the

past seven tax years.

This file will be updated on the

first working day of the month.

The second file,

Delinquent Tax File, is

a complete list of all delinquent

certificates, City held and those

held by individuals and companies.

This file contains more

information than the first and is

considerably larger in size. This

file is updated weekly.

Hernando County

Normally the tax lien sale is the

third or fourth week in May and

usually lasts 2 1/2 to 3 days.

No information re date of sale,

tax lien sale list.

Tax deed sale: first Wednesday of

the month

Hillsborough County

A listing of County held

certificates is available for a

cost of $5.00 + $2.00 postage for

mailing.

A listing of all delinquent

taxes is available for a cost of

$35.00 + $2.00 postage for

mailing.

A public auction is held to sell

property for taxes by the Clerk of

the Circuit Court at a Tax Deed

Sale. Information may be obtained

on properties that are being

auctioned by contacting the Tax

Collector’s office or the Clerk of

the Circuit Court.

County held certificate properties

that are not sold at a Tax Deed

Sale are put on a “List of Lands

Available for Taxes.” Information

may be obtained by the Clerk of

the Circuit Court. Orange County

The

annual Tax Certificate Sale for

the prior year delinquent taxes

will be held via the Internet.

Please visit the Orange County

Tax Collector’s bidding site

www.bidorangecounty.com

for details.

The delinquent accounts will be

posted to the Tax Collector's

web site

www.octaxcol.com

as well as the

www.bidorangecounty.com

site. The delinquent information

will be updated periodically

until the sale.

Palm Beach County

A list of available tax

certificates may be purchased in

person or requested by mail.

Advance payment of $25 is

required. For more information,

call 561-355-2269.

Pinellas County

Tax deed sales lists:

Lands available for taxes are

properties that have been

advertised for sale by the Clerk

at public auction, and no bidders

appeared at the public sale to

purchase the properties. When this

happens, the Clerk is required to

enter the land on a list called

"lands available for taxes" and to

notify the Board of County

Commissioners and all other

persons holding certificates

against the land that the land is

available.

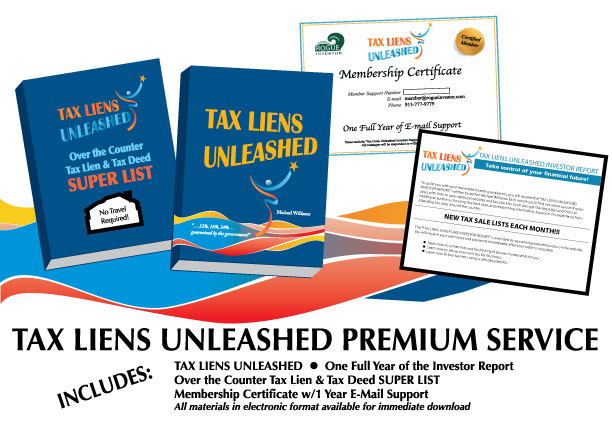

Super list updated each month, includes tax lien lists for Florida

|